A practical guide to establishing valuation

Over the last 12 months one of the most frequent questions we get at Bowman/Hanson is; why are the Canadian companies valued so high? The follow up question is “since there are very few industry “comps”, isn’t it reasonable to apply Canadian valuations to my US cannabis business?”

This document is designed to shed some light into the factors that go into establishing valuation for cannabis companies and provide some practical advice for dealing with the growing number of Canadian companies looking to acquire in California.

Background on Canadian Stock Market

It is important to differentiate between Canada’s Toronto Stock Exchange (TSX) and the Canadian Securities Exchange (CSE). Only CSE stocks are able to hold assets in the US, so we only focus here on the CSE. The CSE is known as an alternative, small cap exchange that offers simplified reporting requirements and reduced barriers to listing. It is designed for smaller, emerging companies and is currently home to 53 cannabis companies.

Alternatives to the Canadian Stock Market

Is Canada the only place to find publicly traded cannabis companies to get a sense of fair valuation? No. Alternatives exist, even in the United States. Some cannabis companies are traded over-the-counter (OTC) and some are traded in other countries, such as Israel.

However, companies with heavily traded shares and a large “public float” (i.e., lots of investors), which would ordinarily provide easy market comps, tend to be engaged in complex businesses largely focused on “non-cannabis” pursuits (e.g. AbbVie NYSE:ABBV or Scotts Miracle-Gro NYSE:SMG). It is almost impossible to untangle the market’s valuation of the cannabis product within a suite of products or a cannabis subsidiary within a conglomerate.

CSE Valuations

Canadian publics are largely valued on future growth potential. However, the CSE does NOT require companies to provide investors with earnings forecasts. The lack of financial data and management accountability creates a very speculative and volatile trading environment. Further, the majority of Canadian companies go public through a “reverse merger” without raising any cash so their balance sheets aren’t typically strong. But it’s early days and there will definitely be some big winners.

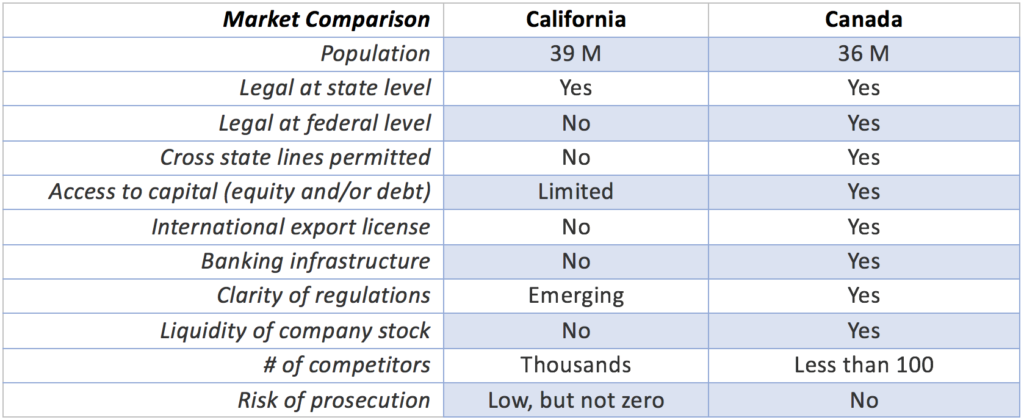

Canada vs. California

Even the brashest Canadian entrepreneurs privately recognize their valuations are aggressive. However, they are also quick to point out the many benefits of Canada, suggesting that any valuation discussion must take into account the “risk profile” of the two markets:

Building a Defensible Valuation

A comprehensive valuation approach that is well packaged for investors/acquirers will support your valuation aspirations far better than “I hear the market is 10x revenue”. To build a defensible valuation profile, consider as many data points as possible and then build sensitivity analysis around the key inputs.

The following are common issues companies discuss when establishing valuations and should serve as levers that can be analyzed and modeled.

10 Common Questions When Establishing Cannabis Valuations

- What level of scale have you achieved?

A company that generates $2m in revenue cannot reasonably apply the same multiple as a company doing over $10m.

- How fast are you growing?

The Cannabis market in California is projected to grow by 45% in 2018. If you aren’t growing FASTER than that – you are losing market share!

- What is your margin profile?

Many companies are pursuing vertical integration because it delivers higher margins. A strong margin profile supports a higher multiple.

- Are you profitable?

Are you still investing heavily into CapEx to scale or have you achieved some level of financial visibility that drives EBITDA? Accretive deals are more valuable than break-even or loss making companies.

- Do you have a ‘Dream Team’ or are you a sole-practitioner?

It’s a people business…who are yours?

- Is your corporate structure clean or complex and confusing?

Do you have a clean Cap Table? Two-year audited financials, taxes paid and proof of revenue through bank accounts? Perhaps your company lacks corporate formalities and legal documentation concerning business formation, existing stockholders from seed financing, loans, etc.? Closing financing or M&A deals requires the proper corporate hygiene.

- How is your company unique and different from your competitors?

Market share in California is extremely volatile with the largest brand achieving a miniscule 7% market share. Just like any consumer products industry, brand innovation and protection/enforcement is critical (California now respects and allows protection for cannabis industry trademarks).

- Do you have comprehensive contracts with key suppliers, customers, distributors, etc.?

Existing relationships, especially when memorialized in a contract, brings value and predictability to the business. Investors love predictability.

- Is your company regulatory compliant?

Having multiple licenses and operational history in each category reduces execution risk. The degree to which a company has achieved operational excellence across multiple disciplines contributes to value.

- Do you have skeletons in the closet?

We all know how entrepreneurs have had to operate over the years in Cannabis. But what risks exist to the historical operational procedures followed (or not) by current or prior management?

This is not an exhaustive list – it is merely a framework to assist in a valuation construct. At the end of the day the specific deal terms in a transaction are typically more important than the valuation – but that’s a story for another day.

We’d love your thoughts, questions and comments. Please don’t hesitate to contact us if you need any support or have questions regarding your cannabis venture, we’d love to hear from you.

Ken Stratton, Rogoway Law Group

P: (415) 432-7990

E: kenstratton@rogowaylaw.com

Erik Ott, Bowman/Hanson, Inc.

P: (415) 377-4158

E: ott@bowmanhanson.com